VAT in the Flower Trade: A Practical Guide for Shop Owners

Before we go any further, we need to state it openly and clearly: all conclusions and recommendations in this material apply specifically to Russian legislation. The flower market in other countries operates under its own rules, and what works in the Russian Federation often has no direct equivalent elsewhere.

We rely on the current provisions of the Tax Code and the latest changes, including the rules set out in draft law No. 1026190-8 (this is the document that changes the tax burden and the VAT framework in 2026). If the state introduces amendments, this article will be updated so it remains useful, accurate and up to date.

Why VAT has become such a critical topic for flower shop owners

If you have been working with flowers for at least a couple of years, you have already noticed: the tax system in Russia has become both much stricter and more predictable at the same time. It sounds paradoxical, but that is exactly what happened. On the one hand, “loopholes” like the patent-based tax regime for retail have been disappearing. On the other, the rules are finally becoming clear, documented and, importantly, transparent.

This is especially sensitive for the flower business. Flowers are a highly delicate product: shelf life is minimal, demand fluctuates like a cardiogram line around February 13–14, and cost price changes literally every week. Add seasonal spikes on top — and it becomes easy to see why VAT questions immediately capture the attention of every shop owner.

There are months when you work steadily and your numbers barely reach a comfortable level. And then March arrives, you “break through the ceiling” in revenue and barely notice how you cross the thresholds that trigger VAT obligations.

Legislative changes have only added fuel to the fire. Draft law No. 1026190-8, adopted on November 20, 2025, revises revenue thresholds, changes the VAT rate and updates the exemption rules. For retail, this all boils down to one thing: running the business “as before” is no longer an option. The new regime does not ask how big your shop is or which city you are in — it applies to everyone who sells flowers officially.

That is why VAT has become topic No. 1 in the flower segment: it is no longer abstract accounting, but a real instrument that affects prices, margins, relationships with suppliers and even how you plan your assortment ahead of peak demand periods.

VAT in simple terms: how it works and where it comes from

What VAT means for a florist — in plain language

Stripping away the accounting terminology, VAT is a tax that “travels” with the product at every stage of its life cycle: from the importer and wholesaler to the flower shop and the end customer.

For a florist, everything comes down to two core concepts:

1. Output VAT

This is the tax you charge when you sell a bouquet to a customer.

If your shop operates under the VAT regime, every receipt includes this percentage, which later goes into your VAT return.

2. Input VAT (credit)

This is the tax you pay to your supplier when you purchase flowers or related products — and which the state allows you to “recover” by offsetting it against your output VAT.

In simple terms, everything you officially purchase from VAT-registered suppliers works in your favor.

And so we are not speaking in generalities, here is a short extract from draft law No. 1026190-8, which amends the relevant article of the Tax Code:

“The value-added tax rate is set at 22 percent…”

(stripped of details here — the point is the rate itself)

This is the rate shops will work with after the reform.

A simple analogy: why VAT is not a fine and not a “tax on thin air”

Many shop owners feel that VAT is just an additional burden. In reality, it is not as daunting as it looks.

Imagine you return glass bottles for a refund. You hand in the container — and you get part of the money back.

VAT works in a very similar way:

- you charge the tax when you sell (output VAT),

-

but then you get part of it back through input VAT from your purchases.

This is why VAT does not always increase a shop’s expenses. In some cases, it is almost neutral:

- if you purchase a large share of your stock officially,

- if you work with major Russian suppliers,

- if you have a stable share of products with full documentation.

Moreover, in some cases VAT can even be advantageous. For example, a shop that fully switches to official purchasing can reduce its final tax burden to the point where operating under VAT is cheaper than under a simplified tax regime.

It sounds counterintuitive, but the numbers often tell exactly this story.

Who can still operate without VAT

How VAT exemption thresholds work — and why they are being reduced

The most common misconception among florists is: “my shop is small, this does not affect me.” Unfortunately, it does.

VAT exemption in Russia depends on your annual revenue. Due to the reform set out in draft law No. 1026190-8, the thresholds are being gradually reduced:

- RUB 20 million in 2026,

- RUB 15 million in 2027,

- and then RUB 10 million per year.

The reason is that the state is trying to bring retail trade into a transparent playing field, and the flower industry is one of the most sensitive segments.

When does an entrepreneur lose the right to exemption?

- if their revenue exceeds the established threshold by year-end,

- or if the threshold is exceeded in any single month during the year (the cash method applies — we count actual cash inflows).

As soon as the threshold is “broken”, the shop automatically becomes a VAT payer.

Can a small shop realistically stay without VAT?

The short answer is yes, it can — but with caveats. The flower business is a roller coaster. In winter, revenue is low and stable. A small kiosk can steadily show RUB 500,000–900,000 per month and stay comfortably below the threshold.

But when February 14 and March 8 arrive, that small shop suddenly looks very large: revenue for a couple of weeks can equal two months of normal trading.

This is the moment when an entrepreneur “falls off” the exemption, even if the rest of the year they were operating within a comfortable range.

A simple example: a kiosk next to a metro station works quietly and steadily. From November through January it barely brings in RUB 700,000–800,000 per month. But in March the till shows an extra RUB 2–3 million — and the threshold is exceeded long before the owner has time to adjust.

So yes, a small shop without VAT is possible. But only if the owner tracks cash inflows every month instead of relying on “gut feeling”.

Should florists be afraid of the 5% and 22% VAT rates

When the 5% rate is beneficial — and when it is not

At first glance, a 5% rate looks like a gift. It sounds simple: “pay less and sleep well.”

But, as often happens in accounting, there is a nuance behind the attractive number: the 5% rate is not beneficial for everyone.

It only works well in one scenario: when the shop has very few official expenses.

That is, when:

- you buy stock partially or entirely in cash “off the books”;

- you buy from suppliers that do not charge VAT;

- your lease is structured in a very simple, informal way;

- official payroll is minimal;

- you have very few expenses that you can document for tax purposes.

Why is that? Because the 5% rate does not allow you to reclaim input VAT, which means you effectively pay tax on your full revenue, without any compensation for your purchases.

To make this even clearer, let us look at a simple example.

Example of a calculation with the 5% rate

Let us assume:

- annual revenue is RUB 20 million,

- of which only 20% (RUB 4 million) are documented purchases.

VAT at 5%:

20,000,000 × 5% = RUB 1,000,000 in tax

Since there is almost no input VAT (purchasing is “off the books”), there is nothing to offset. In practice, you pay a full million in “clean” tax burden. In cases like this, the 5% rate is indeed the simpler and more logical option.

When the 5% rate becomes a bad deal

Now a different situation:

- your shop purchases everything officially;

- 60–80% of expenses include VAT;

- you spend heavily on packaging, décor, rent and payroll.

In this scenario, the “magic” of input VAT starts working — and the 5% rate effectively turns into a “tax on revenue”. You pay tax on the entire sales amount, even though your expenses are substantial.

When the 22% rate can be fairer and even more profitable

This sounds strange, especially for small shop owners. On the face of it: how can 22% ever be better than 5%? But yes, the “full” VAT rate can sometimes leave more money in your till than the reduced rate.

This happens in two main cases:

1. Your business has low margins and high documented expenses. The 5% rate is a turnover tax. You pay it on your entire revenue, even if you are breaking even. The state does not care how much you spent on stock. The 22% rate is a tax on added value. If you bought a stem for RUB 100 and sold it for RUB 120, you only pay tax on the difference (RUB 20).

That is why 22% is more advantageous if:

- you purchase flowers officially from VAT-registered suppliers (you have substantial input VAT to offset);

- your documented expenses (purchases, VAT-inclusive rent, utilities) account for more than 80% of revenue.

2. You work with corporate (B2B) clients. If you service offices, hotels or large corporate events, your VAT status is critical for them.

- At 5%, you do not give them any input VAT to reclaim. A large client loses money by working with you and may switch to a competitor on the standard rate.

- At 22%, you issue full VAT invoices. You become a financially attractive partner.

A mini-example: when the math favors 22%

Let us take a shop that operates fully “above board”, pays high rent and buys premium flowers.

Given:

- Revenue: RUB 40 million

- Documented expenses (stock, rent, VAT-inclusive services): RUB 33 million (82.5% of revenue — tough, but realistic for many).

Scenario 1: You chose the reduced 5% rate. The calculation here is straightforward. Expenses cannot be deducted. 40,000,000 × 5% = RUB 2,000,000 in tax. Result: you pay RUB 2 million.

Scenario 2: You stay on the standard 22% rate. We calculate VAT “inside” the amounts (using the 22/122 fraction):

- Output VAT (what you owe the state on sales): 40 million × (22/122) ≈ RUB 7,213,000

- Input VAT (what the state effectively owes you on your purchases): 33 million × (22/122) ≈ RUB 5,950,000

- Net VAT payable: 7,213,000 − 5,950,000 = RUB 1,263,000

Result: at the 22% rate you pay RUB 737,000 less than at 5%.

Conclusion: if your flower business is built on high markups and low documented expenses, the 5% rate is the obvious choice. But if you have high turnover, expensive stock and corporate clients, the standard 22% rate can be your safety net rather than a penalty.

How to choose a tax regime: simplified systems or VAT

Simplified “income” regime: who it suits

This is the classic option that has been working for about 20 years now.

It is an ideal fit for shops that:

- have minimal documented expenses;

- buy through “grey channels”;

- have a small team;

- rarely exceed the revenue thresholds.

The 6% rate (or a reduced rate, if your region offers incentives) is easy to calculate “in your head”.

A simple example:

The shop earns RUB 12 million. Documented expenses are almost zero.

12,000,000 × 6% = RUB 720,000 per year

If this shop were operating under VAT, the difference in tax burden would be much more noticeable.

“Income minus expenses” simplified regime: when it is the best option

This variant becomes optimal if:

- documented expenses account for 50–60% or more;

- you pay rent, salaries and payroll taxes;

- you buy flowers from compliant, tax-registered suppliers;

- you use packaging, materials and tools that are fully documented.

This is often the case for shops that:

- have grown significantly,

- operate several locations,

- employ a team of florists, sales staff and drivers.

The nominal rate is higher, but tax is paid on profit rather than on turnover.

If a shop earns RUB 30 million in revenue and spends RUB 20–22 million, the “income minus expenses” regime becomes a real lifesaver.

AUSN: pros and limitations for a flower shop

AUSN is an automated simplified tax system that many business owners underestimate. However, it can be very convenient specifically for flower retail (you need to check whether this regime is available in your region).

Its key advantages:

- the tax authority does the calculations — the risk of error is minimal;

- the rate is fixed (8% of income or 20% of profit);

- no regular tax reporting is required;

- you do not pay additional social contributions for employees (they are effectively included in the rate).

But there are constraints:

- revenue must not exceed RUB 60 million;

- no more than 5 employees;

- you must use an account with an authorized bank.

Why do many shops choose AUSN?

Because:

- the team is small;

- expenses are hard to document;

- there is a lot of operational work and very little time for accounting;

- in some cases 8% turns out to be more cost-effective than 6% under the classic simplified regime plus payroll and social contributions.

For a small flower business, it can be a genuinely convenient system.

How VAT changes the day-to-day operations of a flower shop

Switching to VAT is not just about new numbers in the tax return. It also means a certain amount of adjustment in day-to-day processes — changes you get used to within a couple of weeks once you understand what is happening and why.

Working with fiscal data operators and mapping receipts

When a shop works with VAT, every single receipt becomes part of your tax records.

This means:

- it is critical to select the correct VAT rate at the cash register;

- you must correctly record advances and prepayments;

- you need to ensure that refunds are processed under the correct scenario.

The FDO (fiscal data operator) effectively becomes your small assistant. It collects the data that will flow into your tax reports. If there is an error in a receipt, your VAT figures “jump” and can distort the picture for the entire month.

The good news? Most modern cash registers already handle VAT without headaches. You just need to configure the rates once.

Incoming documents from suppliers

For shops that purchase stock officially, a pleasant part of the work appears: input VAT. Every delivery note and every VAT invoice now works to reduce your tax bill.

That is why it is important to:

- avoid losing documents;

- ask suppliers to send them promptly;

- store everything in electronic form — it is much easier to manage.

This is not bureaucracy for the sake of bureaucracy — this is your money.

How pricing changes

The end customer rarely thinks about taxes. They choose a bouquet based on what they see and feel.

That is why shops switching to VAT usually choose one of two approaches:

- slightly adjust prices (but without dramatic changes),

- or keep price tags as they are, compensating for VAT through smarter purchasing.

In reality, VAT does not have to lead to higher prices. If the shop operates “in the clear” and has input VAT, the effective tax burden is often lower than it looks on paper.

Why not all shops will raise prices

There are three main reasons:

- competition — no one wants to scare off customers;

- input VAT reduces the burden — which means you can keep familiar price points;

- intelligent pricing — only part of the assortment is adjusted, not everything at once.

In the flower business, flexibility is essential. VAT affects prices far more gently than, for example, a sudden spike in procurement costs for imported roses.

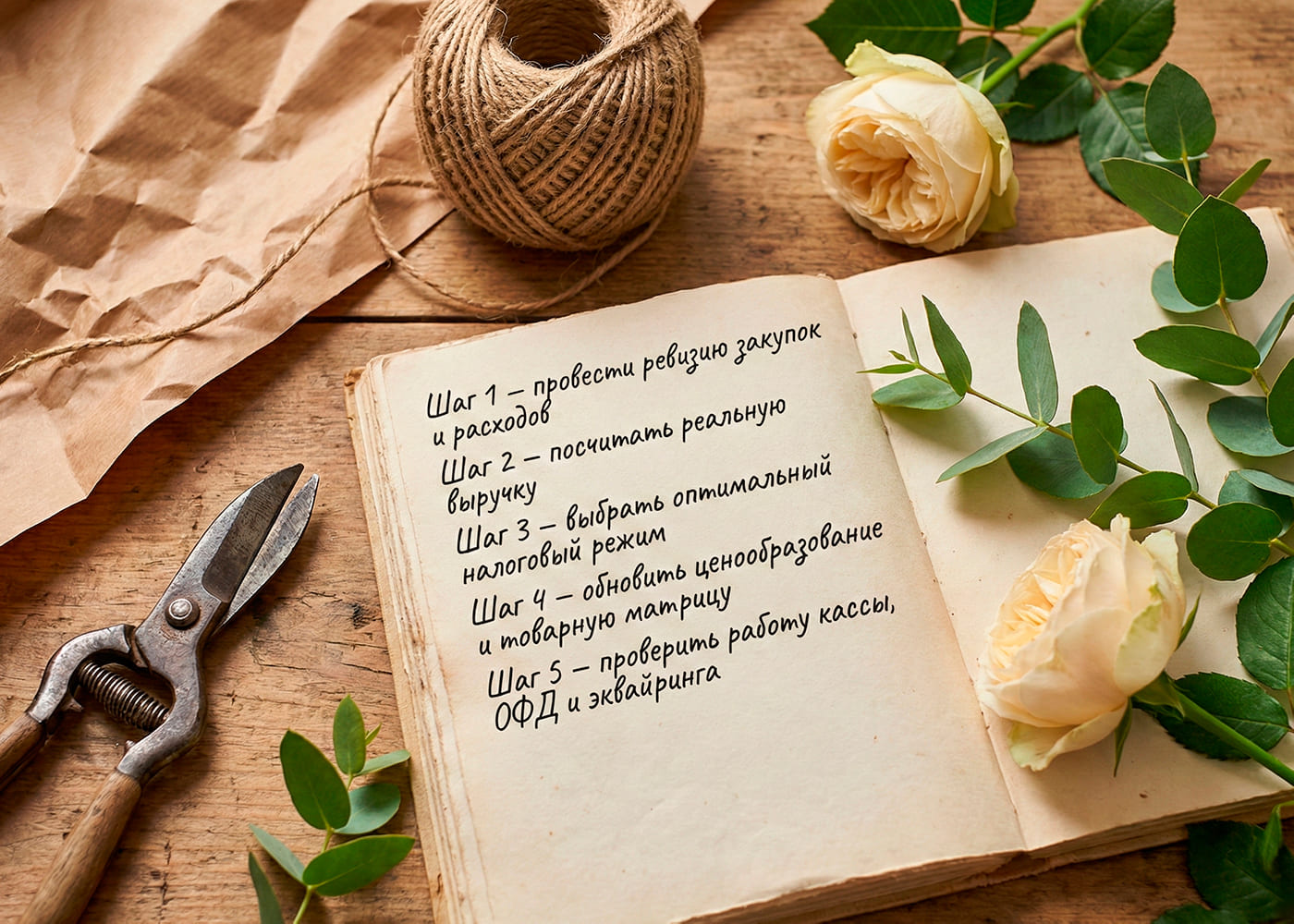

A practical action plan for flower shop owners right now

Step 1 — review your purchasing and expenses

Gather the data:

- where you buy flowers;

- which suppliers charge VAT;

- what share of your expenses is documented;

- what can be moved “into the light” without harming the business.

This is the foundation for choosing a tax regime.

Step 2 — calculate real revenue using the cash method

VAT is based not on your “revenue by feel”, but on actual cash inflows.

That is why it is important to:

- add up all inflows to the settlement account,

- include cash revenue,

- exclude refunds and obvious errors.

This way you will see whether you are approaching the threshold.

Step 3 — choose the optimal tax regime

At this stage it is already clear:

- whether the simplified “income” regime is suitable for you;

- whether the “income minus expenses” simplified regime is more profitable;

- whether you qualify for AUSN;

- or whether it is time to prepare for VAT.

The decision must be based on numbers, not on myths.

Step 4 — update pricing and your product mix

Raising prices is not always necessary.

Sometimes it is enough to:

- adjust margins for selected SKUs;

- cut back on items with heavy cost price;

- add categories with stronger markups.

Your product matrix is not set in stone. It should evolve in line with the new tax reality.

Step 5 — check how your cash registers, FDO and acquiring work

A simple check that protects you from many errors:

- VAT rates are configured correctly;

- the fiscal data operator transmits data without failures;

- all cash registers are updated to the latest version;

- card acquiring correctly reflects incoming payments.

All of this can be done in a single evening — and it will save you a lot of nerves later.

Short summary: the essentials of VAT for florists

VAT is not the enemy of the flower business — it is simply a new part of the rules of the game. Yes, it requires more attention, but it does not break your shop’s operations if you approach it thoughtfully.

Shops that monitor revenue, keep their paperwork in order and choose an appropriate regime go through the reform calmly and confidently. Official purchasing, competent pricing and properly configured cash registers make the tax burden predictable and the business more resilient.

And most importantly: VAT does not force you to raise prices or change your business model. It simply forces you to count — and in business, those who count accurately are the ones who win.